Assessing the concerns and support needs of the sector

This report examines the concerns of the self-employed sector and what support & benefits freelancers need in order to make a success of their businesses.

Financial concerns

The results revealed that the highest concern, with almost three in five (58%) freelancers agreeing, was the irregularity of income and unpredictable finances that often comes hand in hand with freelancing.

Interestingly, sole traders (62%) were more concerned about irregularity of income and unpredictable finances compared to limited company directors (46%).

Financial concerns also extended into financial planning for the future with two in five (40%) freelancers expressing concern about not being financially prepared for retirement. This is unsurprising given that we’ve previously found that just 31 per cent of the self-employed are saving into a pension[12] and is particularly concerning considering that more than a quarter (27%) of freelancers have burned through their savings as a result of the pandemic.[13]

Other financial areas of concern for freelancers included dealing with taxes and HMRC (35%) and not being able to access financial support, such as loans and mortgages, due to their self-employed status (30%).

This closely aligns with previous findings showing that almost three-fifths (59%) of freelancers were penalised for being self-employed when applying for a mortgage and over three quarters (77%) of freelancers who were considering applying for a mortgage were concerned it would be difficult because of their self-employed status.[14]

Late payment continues to be a concern, with almost a third (30%) of freelancers concerned by not being paid on time by a client. This echoes our previous research findings – that late payment has become increasingly more common since the beginning of the pandemic, with over third (36%) reporting that instances of late payment had increased. For those who had experienced late payment, almost a quarter (23%) had used all or most of their savings as a result.[15]

Employment benefits

Over a third (34%) of freelancers were concerned by not having access to statutory employment benefits such as maternity and paternity pay, paid holiday and sick pay.

Interestingly, sole traders were more concerned by not having access to statutory employment benefits (37%) compared to limited company directors (23%).

Over a quarter (27%) of freelancers were also concerned about not being able to take time off work due to illness, injury or for caring responsibilities. This was a particular concern for female freelancers (32%) compared to male freelancers (21%).

Access to broadband

How often does your business suffer as a result of a lack of access to or poor coverage of broadband?

Another area that freelancers wanted more support with was being able to access good broadband coverage. The government has already committed to superfast broadband coverage for 85 per cent of the country by 2025. However, the pandemic and associated lockdown restrictions have led to unprecedented working practices, with many freelancers having to adapt to working from home full-time. We already know that prior to the pandemic, 78 per cent of freelancers reported that reliable broadband was the most important requirement for remote working, therefore it’s important that they are able to access good connection.[23]

We wanted to understand how often, if at all, freelancers and their businesses are suffering because of a lack of access to, or poor coverage of broadband.

Concerningly, seven per cent of freelancers reported that their business often suffers as a result of a lack of access to or poor coverage of broadband. A further one per cent actually reported that their business always suffers – due to a lack of access to or poor coverage of broadband – every time they try to use it – which is particularly challenging for those attempting to adapt to working from home.

Similarly, almost one in three (28%) reported that their business sometimes suffers as a result of a lack of access to or poor coverage of broadband whereas 34 per cent report that their business rarely suffers and a further 28 per cent report that their business never suffers.

With over a third (36%) of freelancers stating that their business suffers, at least sometimes, as a result of a lack of access to or poor coverage of broadband, there is clearly more that needs to be done to support the sector.

Government support

The pandemic has had a devastating impact on many freelancers, with 67 per cent reporting a negative impact on their freelance businesses and 60 per cent reporting a decrease in turnover over the last 12 months. Gaps in government support left approximately 1.6 million of the 5 million people who were self-employed at the start of the pandemic excluded from support.32 This includes those new to self-employment, those with annual profits of over £50,000 and limited company directors.

While some newly self-employed people were included in the later rounds of SEISS, limited company directors and other groups continue to be excluded from support, leaving some mired in debt and others being forced out of self-employment altogether.

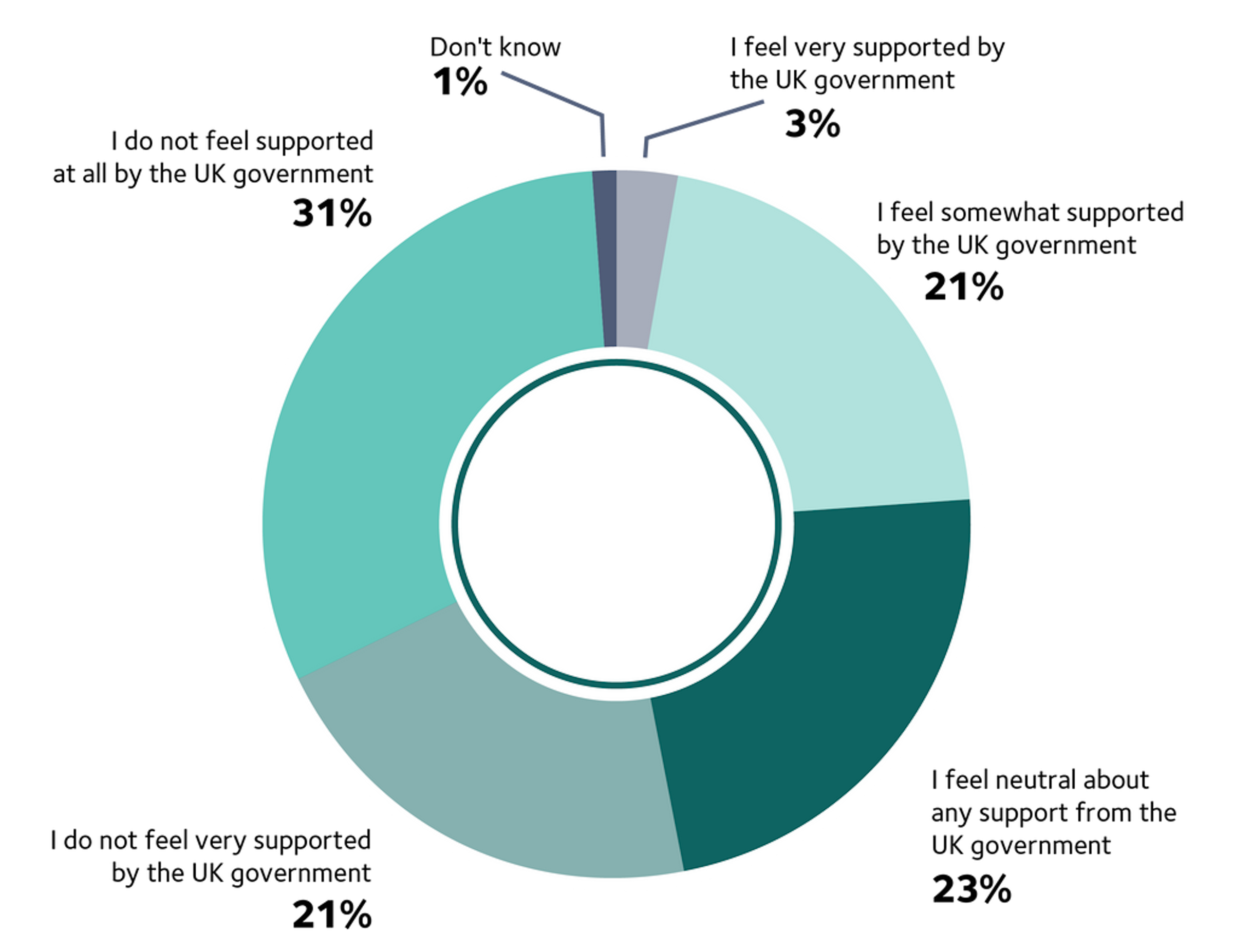

To understand the impact of this, we asked freelancers to what extent they felt supported by the UK government. Over half (52%) reported that they do not feel supported by the UK government, including 31 per cent reported that they do not feel supported at all by the UK government. This can be attributed to both the support gaps throughout the pandemic and also the introduction of IR35 reforms in the private sector leading to freelancers feeling they are being actively targeted by the government.

The figure rose to 67 per cent for limited company directors, who were largely unable to access government support through the pandemic compared to 48 per cent for sole traders, many of whom were able to make use of the SEISS grants. Limited company directors, in particular, were more likely to report that they do not feel supported at all, with 44 per cent reporting this compared to 27 per cent of sole traders.

A further 25 per cent felt either very or somewhat supported by the government with only three per cent feeling very supported. A total of 28 per cent of sole traders felt either very or somewhat supported compared to just 12 per cent of limited company directors, with the difference representative of support gaps.

UK Government support

Appendix

Latest news & opinions

Small businesses often struggle with expensive and ineffective marketing options. Could athlete sponsorship offer the solution?

Fred Hicks looks at the problem of late payment for freelancers and weighs up whether the government's new Fair Payment Code will make a meaningful impact on the ...

Nearly four in ten self-employed people have thought about giving up their entrepreneurial lifestyle just to secure a mortgage. But, with the right preparation an...