Making the case for freelancers

This report assesses the role that freelancers play in providing value for businesses whilst evaluating the attitudes of employees to those that work for themselves and the likelihood of these employees to enter self-employment.

Identifying the value of freelancers to businesses

Previous IPSE research has revealed that the solo self-employed – individuals who run their own business, operating as a sole trader or in a partnership and do not have any employees – contribute an estimated £303 billion to the UK economy.[5]

Similarly, freelancers – a subsection of the solo self-employed population working in the top three highest skilled occupational categories (SOC1 to SOC3) in occupations such as lawyers, scientists and designers – are also estimated to contribute £147 billion to the UK economy.

In addition, we also know that the majority of clients (76%) reported that freelancers are a valuable resource to their business from our survey of clients in 2021.[6]

In order to understand the precise value that freelancers add to these clients, we asked, as part of this survey of clients in 2021, how freelancers provide value for these businesses.

The majority of clients (66%) reported that freelancers bring specialised talent to their business whilst a further 62 per cent indicated that freelancers enhance the flexibility and agility of the business.

Over half (52%) cited the fact that freelancers enable businesses to go beyond the limits of their internal resource base and another 52 per cent reported that they enable businesses to maximise the performance of peaks and troughs in demand.

Similarly, a further third of clients (33%) reported that freelancers provide value to their business by bringing fresh ideas.

In addition, a quarter of clients (25%) stated that freelancers are sources of innovation whilst 23 per cent reported that they reduce business risk and 13 per cent stated that they reduced the amount of finance required for innovation.

Attitudes towards self-employment

Perceived benefits of self-employment

In total, almost two-fifths of employees (39%) reported that they have considered working for themselves, with those currently employed in media, marketing, advertising, PR and sales roles (57%) and those in construction roles (47%) more likely to have considered making the move across to self-employment.

In order to understand the perceived advantages of self-employment, we asked those employees that had considered working for themselves of the potential reasons behind this consideration.

Of those employees that had considered working for themselves, almost half (49%) cited flexibility as a reason for why they have considered self-employment whilst a further 48 per cent identified the reason as being able to the be their own boss.

In addition, almost half of employees (48%) cited an improved work-life balance as a perceived benefit of self-employment whilst one-third (34%) had considered self-employment due to its independence over areas such as creative freedom and choice of clients.

Interestingly, a third of employees (33%) believed that they could make more money working for themselves whereas 30 per cent indicated that they had considered self-employment due to being unhappy in previous employment.

Other responses from employees on why they had considered self-employment included being able to follow their passion (27%), avoidance of office politics (23%), for better work conditions (22%), greater control over their financial future (18%) and being made redundant or having a lack of work opportunities (15%).

Additionally, seven per cent reported that changing priorities during the coronavirus pandemic had led them to consider working for themselves.

A further six per cent had considered self-employment due to childcare needs whilst another six per cent reported it was due to ownership of intellectual property.

Just four per cent reported that they had considered working for themselves as they had found a gap or opportunity in the market.

Contribution to UK economy and society

Previous IPSE research has revealed that the solo self-employed – individuals who run their own business, operating as a sole trader or in a partnership and do not have any employees – contribute an estimated £303 billion to the UK economy,7 but much less is known about the perceived contribution of the self-employed to UK society.

In order to understand overall attitudes towards the self-employed, we asked our employee respondents about their view of their self-employed counterparts in terms of their perceived contribution to both the UK economy and society.

In total, the overwhelming majority of employees (72%) reported that the contribution the self-employed make to the UK economy and society is either fairly or very positive.

Just four per cent of employees reported that the contribution of the self-employed is either fairly or very negative whilst 15 per cent were neutral.

‘Overall, what is your impression of people who work for themselves?’

In order to understand the attitudes and views held towards self-employment, we asked employees, in an open box question, about their overall impression of people who work for themselves.

Whilst employees pay tax automatically through PAYE, the tax system is more complex for the self-employed. Those operating through their own limited company pay corporation tax or tax on any dividends paid to directors whereas those operating as sole traders pay income tax based on their profits for each tax year.

Similarly, there is also a difference between how employees and the self-employed pay National Insurance Contributions, with employees paying Class 1 whereas self-employed individuals typically pay Class 2 and Class 4.

As a result of these differences in how tax is paid, there is a perception amongst some of our employee respondents that the self-employed benefit from these tax arrangements, with many of these respondents associating this with the entrepreneurial risk associated with entering self-employment and foregoing employment rights.

In total, six per cent of responses to this open box question referred to some advantage of the tax system or an impression that those that work for themselves pay less tax.

“Mix of honest and dishonest operators when tax is involved - give impression that permanent staff bear more of the tax burden.”

"“Entrepreneurial BUT often engage in tax avoidance and don’t contribute their fair share to tax/NIC.”

“People who work for themselves are brave, drive and motivated, but I doubt they pay their tax the same as other employed workers.”

Interestingly, when asked about their impression of those that work for themselves, many referred to the self-employed as following a passion or enjoying their work, with some responses also noting the need for more government support for people choosing to follow their passion.

“People who work for themselves are often passionate about what they do - they are not just working for a salary. They are reliant on having a good reputation so usually really care about what they do and do a good service and care about their customers.”

“I think they’re passionate, driven and essential to society but the government makes it too difficult for them to run.”

“Positive impression - they have the motivation to set up and work at something they enjoy.”

“Passionate, clever but they don't get a lot of support from the government in my opinion which makes it scary to think about doing. So people who are self-employed are brave they've taken a leap.”

There was also an understanding from some respondents that self-employment is incredibly varied, offering career opportunities to those in multiple sectors and for differing motivations.

"There are all different kinds of self-employed people. I live where there a lot of self-employed people and they are all hardworking and skilled.”

"I admire people who work for themselves, albeit I'm also aware that there's a diverse range of people with different motivations for doing so. Having had a parent who was self-employed for many years I understand the challenges and hardships that go with being self-employed."

Other employees cited the entrepreneurial drive and risk required to enter self-employment when asked about their overall impression of those in self-employment.

“They accept a higher level of risk and can therefore gain greater rewards.”

“I have a positive impression of people who are self-employed. It requires confidence, a lot of work and commitment as well as an idea for making money and seeing an opportunity.”

“I respect the belief and effort put into starting one's own business.”

“Productive. Good for the economy.”

Many also referred to the perceived hard-work and undertaking of long hours by those in self-employment whilst others indicated that they admire the brave decision to enter self-employment, often citing the lack of job security and employment rights.

“Driven, risk takers, passionate, clever, social, hard working.”

“Generally hard working and more methodical in their approach to delivering a better service. Also, less likely to be unavailable through holidays and sickness.”

“They work very hard but have more freedom to pick & choose when they work.”

“Brave, dedicated and willing to commit all their time to their job.”

“I admire them for doing it but it is not something I would consider as I like job security.”

“I’d say they’re quite ambitious and have an entrepreneurial spirit which allows them to overcome aspects which I personally see as limits/issues such as lack of job security.”

“Maybe they are stressed due to lack of job security, typically work longer hours and have more problems with work life balance, although they have a bit more freedom to take time off when they need to.”

Other responses focused on the overall contribution of the self-employed to the UK economy and to the overall workforce.

“They are the backbone of the economy. They often employ other people despite being self-employed. They create jobs and wealth. They take the risks that are not involved in many other areas of work, i.e. in the public sector.”

“Such a broad spectrum of reasons to be self-employed. Everyone in the arts, most subcontractors, consultants, designers... Self-employment means proficiency and professionalism generally, with the number of certifications and awards really important to seeking services, as opposed to working in a larger company as a cog.”

Overall, whilst a small proportion of employees focused on the perceived tax advantage when asked about their opinion of those that work for themselves, the overwhelming majority highlighted the vital and diverse contribution that the self-employed provide to businesses and the UK economy. Notably, the most common perception of freelancers amongst employees was of hard-working and driven individuals that are brave to work for themselves and forego employment rights and job security.

The role of side hustles in the UK economy

Side hustles are a secondary role, business or gig that a person takes on in addition to their primary job, often to supplement their income such as setting up a handmade crafts business, tutoring or selling homemade goods.

Our research now reveals that 12 per cent of employees currently have a side hustle in the UK.

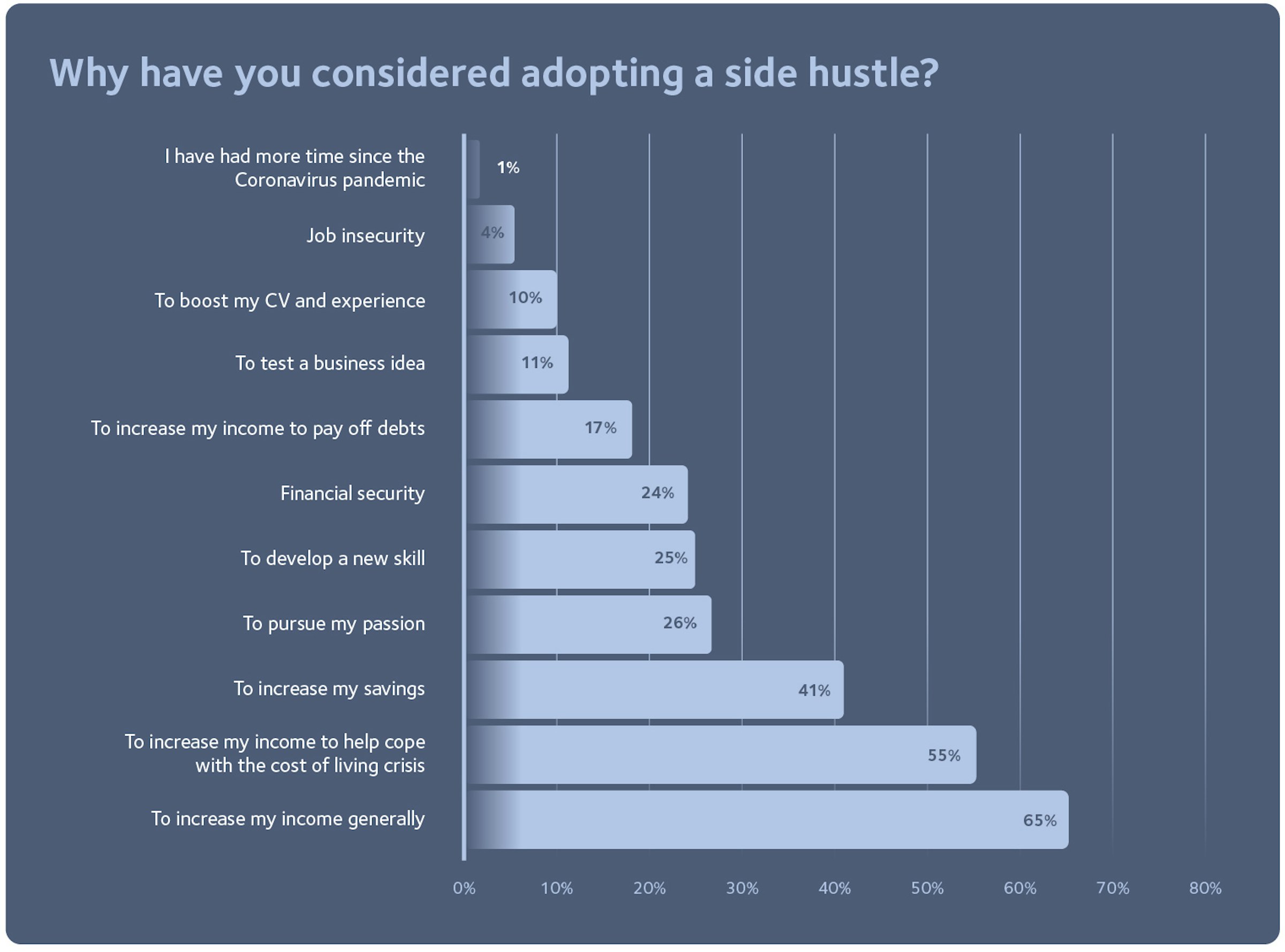

Interestingly, almost half of employees (46%) indicated that they don’t currently have a side hustle but would consider it in the future whereas two-fifths (40%) reported that they don’t currently have a side hustle and it’s not something they would consider in the future.

Looking across gender as a breakdown, women were slightly more likely than their male employee counterparts to be currently adopting a side hustle (14% compared to 11% respectively).

Employees operating in the media, marketing, advertising, PR and sales industry were most likely to be currently adopting a side hustle (28%) whilst a fifth (20%) employees operating in hospitality and leisure roles are also currently adopt a side hustle.

In addition, those aged under 44 years old were more likely to report that they would consider a side hustle in the future (56%) compared to those aged over 44 years old (39%).

Exploring the rise of side hustles among employees

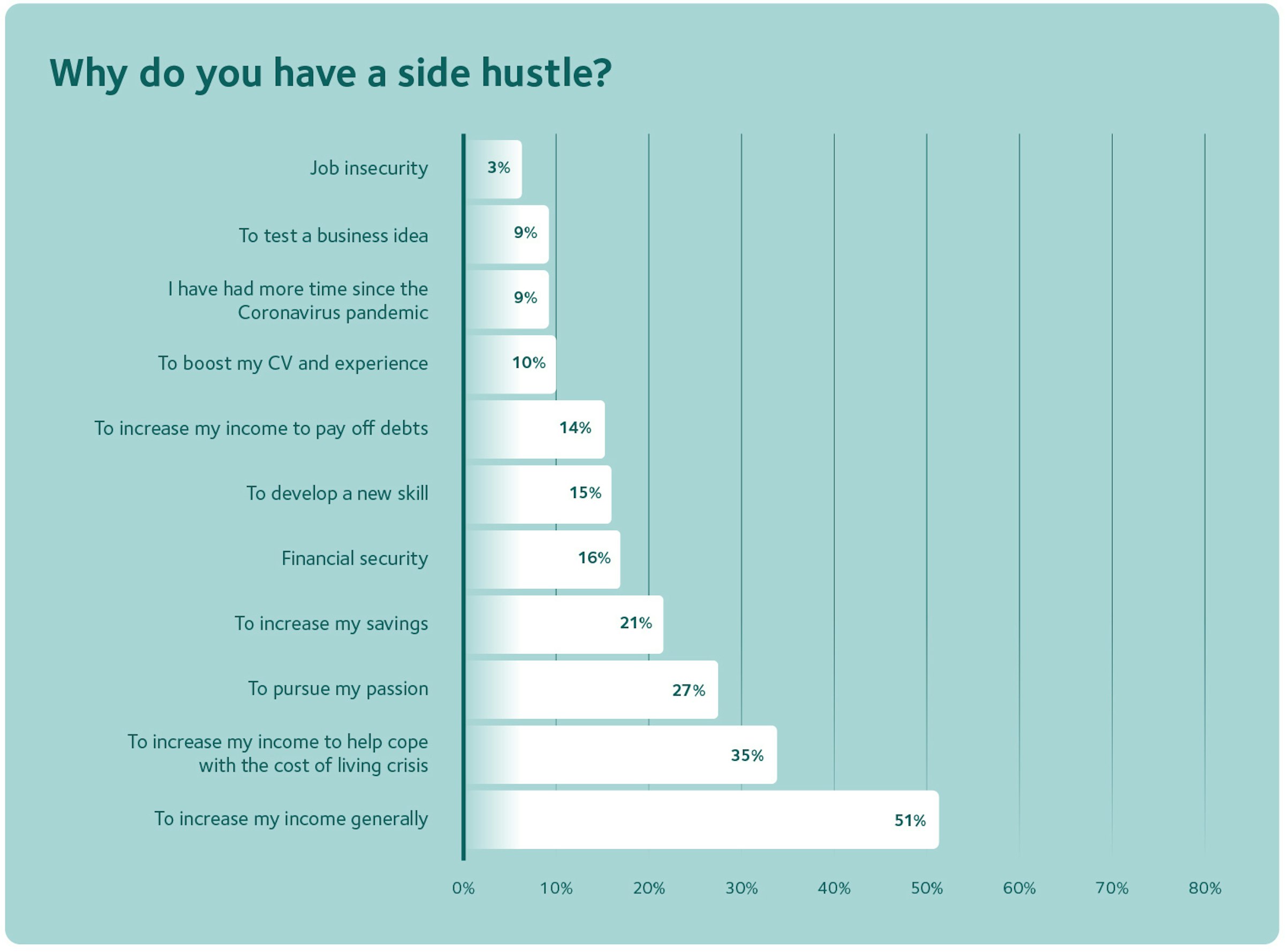

Of those who reported that they currently have a side hustle, over half (51%) reported that it was to increase their income generally whilst a further 35 per cent indicated that it was to increase their income to help them cope with the current cost of living crisis.

Similarly, 27 per cent reported that they have a side hustle to pursue their passion whilst 21 per cent stated that it was increase their savings.

In addition, 16 per cent reported that they have a side hustle to provide them with additional financial security whilst 15 per cent indicated their side hustle was to allow them to develop a new skill.

Other responses to why these employees are undertaking a side hustle included being able to increase their income to pay off debts (14%), to boost their CV and experience (10%), to test a business idea (9%), having more time since the Coronavirus pandemic (9%) and current job insecurity (3%).

Likelihood to enter self-employment

Our research now reveals that 28 per cent of employees in the UK can see themselves becoming self-employed in the future.

A further 57 per cent of employees could not envisage becoming self-employed in the future whilst 15 per cent were unsure.

Male employees were slightly more likely than their female counterparts to envisage themselves becoming self-employed in the future (30% compared to 25% respectively).

Interestingly, those aged 44 years and younger were more likely to see themselves entering self-employment in the future than those aged 45 and older (36% compared to 22% respectively).

We also asked those employees who would consider entering self-employment which areas of information and advice would they need before making the move across to self-employment in order to understand potential barriers and gaps in knowledge.

In total, of those who would consider entering self-employment, over half (52%) indicated that they wanted more advice and information about the tax system before making the move across.

Similarly, 43 per cent reported that they wanted further information and advice around creating a business plan whilst another 43 per cent indicated that they wanted support with financial planning.

Other responses to areas were further advice and information would be needed before making the move to self-employment included how to structure a business (37%), pension and saving for late life options (34%), invoicing (27%), setting rates (27%) and support with branding and marketing (25%).

A further 23 per cent of those who would consider entering self-employment reported that they wanted further advice and information about networking prior to making the move across to self-employment.

Notably, just 12 per cent of employees reported that there were no areas that they would want more information or advice on before making the move to self-employment.

Appendix

Latest news & opinions

Small businesses often struggle with expensive and ineffective marketing options. Could athlete sponsorship offer the solution?

Fred Hicks looks at the problem of late payment for freelancers and weighs up whether the government's new Fair Payment Code will make a meaningful impact on the ...

Nearly four in ten self-employed people have thought about giving up their entrepreneurial lifestyle just to secure a mortgage. But, with the right preparation an...